SWAYAM Scheme Odisha, how to apply, motive, benefits, beneficiary, eligibility, documents, official website, helpline number | स्वतंत्र युवा उद्यमी योजना, आवेदन कैसे करे, उद्देश्य, लाभ, लाभार्थी, योग्यता, दस्तावेज, आधिकारिक वेबसाइट, हेल्पलाइन नम्बर

Many schemes have been launched by all the state governments and central governments to promote small and micro enterprises in the country. Similarly, this scheme has been started by the Odisha state government to provide partnership and a collective sales offer to the youth of the state.

The most productive class in any society is the youth. This scheme has been started to empower them and encourage them to set up enterprises. In this, mainly the youth of economically weaker sections will benefit. Under this scheme, these youth will be given interest-free loans up to a maximum of Rs 1 lakh.

What is the Aim of Udyogini Scheme

Contents

- 1 SWAYAM Scheme Odisha

- 2 SWAYAM Scheme Objectives

- 3 SWAYAM Scheme Odisha Benefits

- 4 SWAYAM Scheme Odisha Comparison Between Rural and Urban on Different Factors

- 5 SWAYAM Scheme Odisha Eligibility Criteria

- 6 SWAYAM Scheme Ineligibility Criteria

- 7 SWAYAM Scheme Documents

- 8 SWAYAM Scheme Odisha Government Apply Online

- 9 SWAYAM Scheme Check Status Online Odisha

- 10 SWAYAM Scheme Applicant Login

- 11 SWAYAM Scheme State Login

- 12 SWAYAM Scheme District Login

- 13 SWAYAM Scheme BPC/BDO Login

- 14 SWAYAM Scheme Bank Login

- 15 FAQ

SWAYAM Scheme Odisha

| Name of Scheme | SWAYAM Scheme |

| Started by | Odisha Government |

| Motive | By this scheme |

| Benefits | Provides financial assistance of 1 lakh rupees (interest-free loan) |

| Beneficiary | All young Business Owners |

| Budget | 448 crore Rupees |

| How to apply | Online |

| Official website | https://swayam.odisha.gov.in/index.php |

SWAYAM Scheme Objectives

The main objective of this scheme is to encourage the youth of the state to start their enterprises. Under this, every eligible young entrepreneur will be given an interest-free loan of up to Rs 1 lakh. This scheme will also encourage unemployed and poor youth to start their enterprises. Under this scheme, initially, 50,000 youth in urban areas of the state will be given the benefit of this scheme. Free Solar Chulha Yojana Online Registration Process

Odisha's new SWAYAM scheme offers interest-free loans up to Rs 1 lakh and Rs 1,000 livelihood assistance to PDS families. Young entrepreneurs and unemployed youth in Odisha, aged 18-35 with a ration card, can apply for this initiative.https://t.co/PPBvqcATH7@NeerajtIndian30 |… pic.twitter.com/74HUx9OzSk

— Marksmen Daily (@DailyMarksmen) February 15, 2024

SWAYAM Scheme Odisha Benefits

- Under this scheme, unemployed and underemployed youth in both rural and urban areas, who do not have any outstanding loans, are given seed-free loans up to Rs 1 lakh to start their new venture or expand the already running venture. Will go.

- Under this scheme, youth between 18 and 35 years old can start or expand their enterprise with the benefit of this loan. In this, SC, ST, and PWD category youth can avail of benefits till the age of 40 years.

- This scheme will encourage the unemployed youth of the state to start their enterprise or small business and promote local businesses.

- For the proper implementation of this scheme, the Odisha state government has fixed a budget of Rs 448 crore. Madhu Babu Pension Yojana Apply Online

SWAYAM Scheme Odisha Comparison Between Rural and Urban on Different Factors

| Rural | Urban | |

| Commencement and Duration | 2 Years | 5 Years |

| Target of coverage | 1 lakh youth in 2 years | 50,000 youth in 2 years |

| Project Cost | There are no processing fees or service charges | The project cost will be 1 lakh with a 5% margin, so the loan amount will be 95,000 |

| Eligible Lending Institutions | All Public Sector Banks, private scheduled commercial banks, Regional Rural Banks, Co-operative banks covered under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) | All Public Sector Banks, private scheduled commercial banks, Regional Rural Banks, Co-operative banks covered under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) |

| Rate of Interest and Repayment Schedule | the loan will be disbursed in a maximum of 2 installments at a Normal rate of interest. The repayment period will be 4 years with a moratorium period varying from 3 to 6 months | This loan will be disbursed in a maximum 2 installments at a Normal rate of interest. The repayment period will be 4 years with a moratorium period varying from 3 to 6 months |

| Processing Fees | There will be comprehensive insurance coverage for all types of risks including floods and earthquakes for 110 % of the value of the stocks declared by the bank | No processing fees and service charges |

| Insurance Coverage | There will be comprehensive insurance coverage for all types of risks including floods and earthquakes for 110 % of the value of the stocks declared by the bank | The borrower will deposit only 5 % of the loan amount with bank as margin money in advance. |

| Margin Money | The borrower will deposit only 5 % of the loan amount with the bank as margin money in advance. | |

| Collateral | There are no processing fees and service charges | No collateral is required for the sanction of the loan |

SWAYAM Scheme Odisha Eligibility Criteria

For Rural Applicants

- Only the youth of Uday state, whose age is between 18 to 35 years can take benefit from this scheme.

- Under the scheme, the maximum age limit for SC, ST, and PWD categories has been kept at 40 years.

- If the applicants of the scheme are beneficiaries of the KALIA/BSKY scheme or their income is less than Rs 2 lakh per year, then they will get the benefit.

- Under the scheme, the applicant should have a number issued by UDYAM.

For Urban Applicants

- Under this, those youth of Odisha state whose age is 18 to 35 years can apply. In this, the maximum age limit for SC, ST, PWD, and transgender applicants has been kept at 40 years.

- Under the scheme, if the applicant’s family is a beneficiary of the BSKY scheme or his family’s annual income is less than Rs 3 lakh, then he can avail of the benefit.

- Apart from this, the applicant should be registered on the UDYAM portal.

Gruha Lakshmi Yojana Karnataka Application

SWAYAM Scheme Ineligibility Criteria

Youths having the following credentials will not get benefits in this scheme:

For Rural Applicants

- If the applicant is a defaulter of the loan taken from the bank or any financial institution under any central or state scheme, then he will not get the benefit.

- If the applicant is an employee of any Central/State Government/PSU or other Statutory bodies, then the benefit will not be available.

- If any other member of the applicant’s family has already availed of the benefit of this scheme, he will not get the benefit.

For Urban Applicants

- If the applicant is a defaulter of the loan taken by the Central/State Government from any bank or financial institution, then he will not get the benefit.

- If the applicant or his family is employed in the Central/State Government or any PSU, he will not get the benefit.

- If any one member of the family has already taken benefit of the scheme under this scheme, then he will not get the benefit.

Indira Gandhi Pyari Behna Samman Nidhi Yojana Apply

SWAYAM Scheme Documents

- Aadhar card

- Pan card

- Cast Certificate

- Domicile certificate

- Age proof documents

- income Certificate

- Address proof

- Bank Account Details

- Mobile number

- Email ID

- Enterprise Registration/Assisted Number

Mukhyamantri Rajshri Yojana Online Apply

SWAYAM Scheme Odisha Government Apply Online

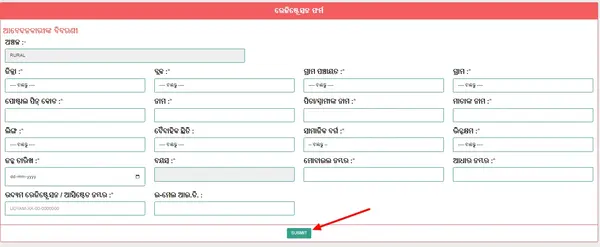

For Rural Applicants

- For this, first of all, you have to go to the official website of the scheme from the given link.

- Then you will have to click on the option named Registration on the home page of this portal and click on the Rural option in the dropdown menu.

- Then on the new page, you will get the form of this scheme.

- Here, first of all, you have to give information about your district, block, gram panchayat, village, pin code, applicant’s name, father’s or husband’s name, mother’s name, gender, and marital status.

- Then you have to fill in his category, disability (if applicable), date of birth, age, mobile number, Aadhar card number, enterprise number, and email ID.

- Then you finally have to submit this form by clicking on the Submit button.

- In this way, you have filled out the form for this scheme.

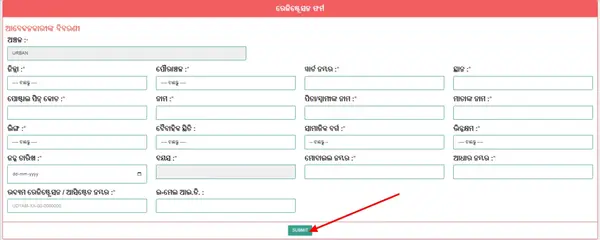

For Urban Applicants

- For this also you will have to go to the official website of the scheme from the given link and click on the Urban option in the Registration option on the homepage.

- Then you will get the scheme form on the new page, which you will have to fill.

- In this, first of all, you will have to give information about district, city, ward number, location, postal pin code, your name, applicant’s father/husband’s name, mother’s name, gender and marital status.

- Then you have to fill in his category, disability (if any), date of birth, age, mobile number, Aadhar card number enterprise registration number email ID, etc.

- Then you have to click on the Submit button.

- In this way, youth living in cities can apply.

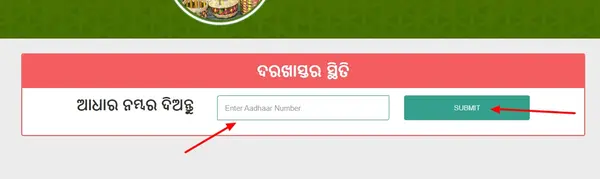

SWAYAM Scheme Check Status Online Odisha

- For this, first of all, you have to go to the link given on the official website of the scheme.

- Then you have to fill in your Aadhar card number to check the status of the application on the home page of this portal.

- Then you will have to click on the Submit button and you will know the status of your application.

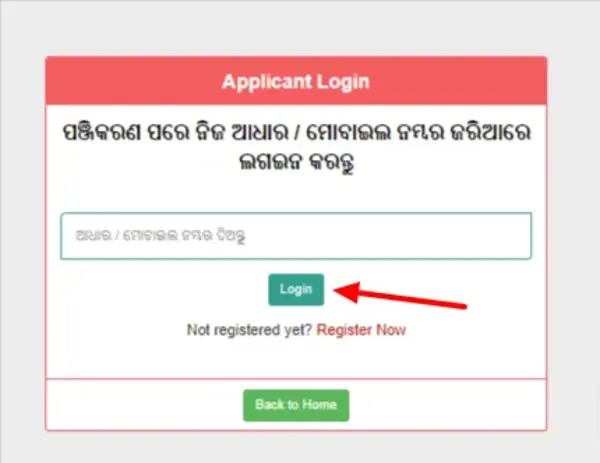

SWAYAM Scheme Applicant Login

- For this, first of all, you have to go to the official website of the scheme from the given link.

- Then you have to click on the Applicant option in the Login option on the home page.

- Then on the new page, you will have to fill in your Aadhar card number or mobile number (which was given while registering) and click on the Login button.

- In this way, applicants can do so.

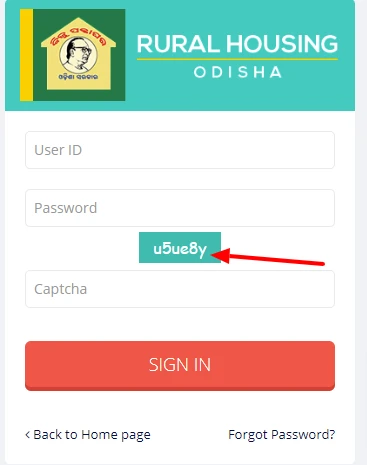

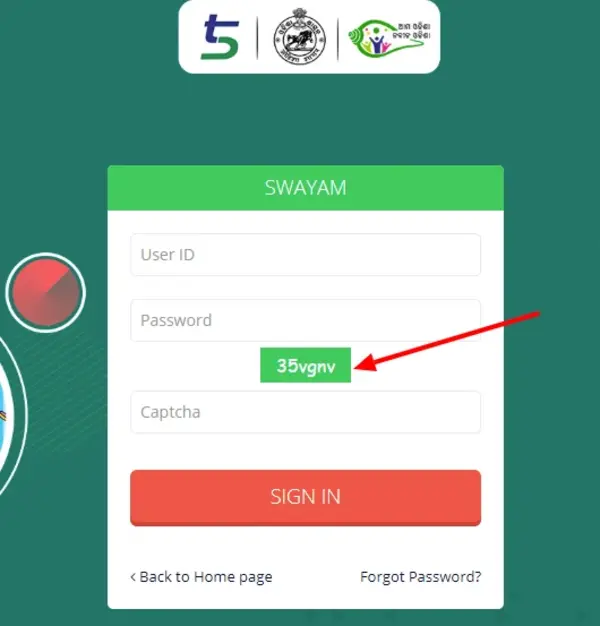

SWAYAM Scheme State Login

- For this, first of all, you have to go to the official website of the scheme from the given link.

- Then you have to click on the State Login option in the Login option.

- Then on the new page User ID and password will have to be filled and the captcha will have to be filled.

- Then you have to click on the Sign in button.

- In this way, you have signed in under this scheme.

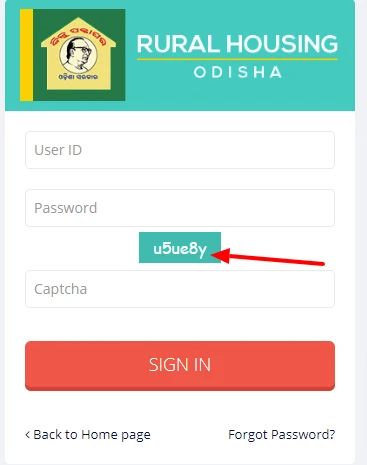

SWAYAM Scheme District Login

- In this also, first of all, you have to go to the official website of the scheme from the link given.

- Then you have to click on the District Login option in the Login option on the home page.

- Then on the new page, you will have to fill in the user ID and password and fill in the captcha code.

- Then you have to click on the Sign in button.

- In this way, you have signed in to it.

Pradhan Mantri Suraksha Bima Yojana Registration

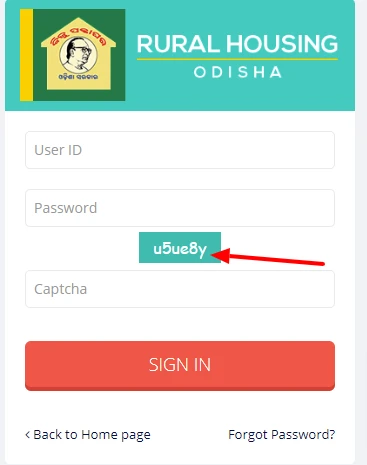

SWAYAM Scheme BPC/BDO Login

- Here also you will have to go to the office portal of the website from the given link and click on the BPC/BDO Login option in the Login option on the home page.

- Then on the new page, you will have to fill in the user ID, password, and captcha code and click on the Sign in button.

- In this way, you will be able to sign in to this portal.

SWAYAM Scheme Bank Login

- Here you have to go to the portal from the given link and there you have to fill in the username and password and fill in the captcha.

- Then you have to click on the Sign in button.

- In this way you have signed in to this portal.

| Swayam Scheme Odisha Official Website | Click Here |

| Swayam Scheme Odisha Online Apply(Rural) | Click Here |

| Swayam Scheme Odisha Registration(Urban) | Click Here |

| SWAYAM Scheme guidelines pdf(Rural) | Click Here |

| SWAYAM Scheme guidelines pdf(Urban) | Click Here |

| Swayam scheme login | Click Here |

| Swayam scheme FAQ | Click Here |

Mukhyamantri Yuva Kaushal Yojana Rajasthan

FAQ

Who is eligible for Swayam scheme in Odisha?

1. Under this scheme, only youth between 18 to 35 years old will get benefits (for ST, SC, and PWD category youth up to 40 years).

2. Under this scheme, the beneficiary youth of KALIA/BSKY will get benefits.

3. The benefit will be available to those who are registered under UDYAM.

What is the new loan scheme in Odisha?

Under this scheme, every eligible youth will be given an interest-free loan of up to Rs 1 lakh. This will encourage unemployed and poor youth of the state to start enterprises.

How to apply Swayam Yojana in Odisha?

Under this, you will first have to go to the official website of the scheme and click on the Rural/Urban option in the registration option, fill out the form on the new page, and click on the submit button.

what is Swayam scheme full form?

Full Form: Swatantra Yuva Udyami

What is the Swayam Yojana?

SWAYAM is an online education initiative launched by the Government of India, providing free access to a variety of courses. This platform, developed by the Indian government, offers Massive Open Online Courses (MOOCs) across various fields, including Science, Engineering and Technology, Humanities and Social Sciences, Law, and Management.